Navigating the labyrinth of energy efficiency incentives can feel overwhelming, but for California homeowners considering a tankless water heater, understanding the potential for a California tax credit for tankless water heater is crucial. Upgrading to a tankless system not only promises on-demand hot water and energy savings, but also opens doors to significant financial benefits. This guide will demystify the intricacies of claiming a California tax credit for tankless water heater, helping you determine eligibility and maximize your savings. By understanding the criteria and carefully documenting your installation, you can significantly reduce the overall cost of your upgrade.

Understanding the Federal Tax Credit (and Why It Might Not Apply as Much Anymore)

While a federal tax credit for energy-efficient appliances, including certain water heaters, existed in the past, its current applicability to tankless water heaters is limited. The Inflation Reduction Act of 2022 updated and extended many energy efficiency tax credits, but the specific requirements for water heaters can be tricky. It’s imperative to consult the IRS guidelines and the manufacturer’s specifications to confirm if your chosen tankless model qualifies for any federal incentives.

- Review IRS Form 5695: This form is used to claim residential energy credits.

- Check Manufacturer Specifications: Confirm that the water heater meets the efficiency standards required for the credit.

- Consult a Tax Professional: Seek expert advice to ensure accurate filing and eligibility.

Exploring California-Specific Incentives and Rebates

While a specific, dedicated “California tax credit for tankless water heater” may not be readily available in the same format as a direct state tax credit, California offers a range of programs and rebates through utility companies and local government initiatives that can significantly offset the cost of a tankless water heater installation. These incentives are designed to promote energy efficiency and water conservation.

Key Programs to Investigate:

- Utility Company Rebates: Southern California Edison, PG&E, and other utility providers often offer rebates for installing energy-efficient appliances. Check your provider’s website for specific details on tankless water heater rebates.

- Local Government Programs: Some cities and counties offer additional incentives for energy-efficient upgrades. Research programs available in your specific location.

- TECH Clean California: This initiative aims to accelerate the adoption of clean heating and cooling technologies. While not directly a tax credit, it can provide rebates and incentives for eligible tankless water heaters.

Documenting Your Installation for Incentive Applications

Regardless of the specific incentive you’re pursuing, meticulous documentation is essential. Keep records of the following:

- Purchase Receipt: The original receipt showing the purchase date, model number, and cost of the tankless water heater.

- Installation Invoice: An invoice from a qualified installer detailing the installation costs.

- Manufacturer Specifications: Documentation proving that the tankless water heater meets the efficiency standards required for the incentive.

- Permits (if required): Copies of any permits obtained for the installation.

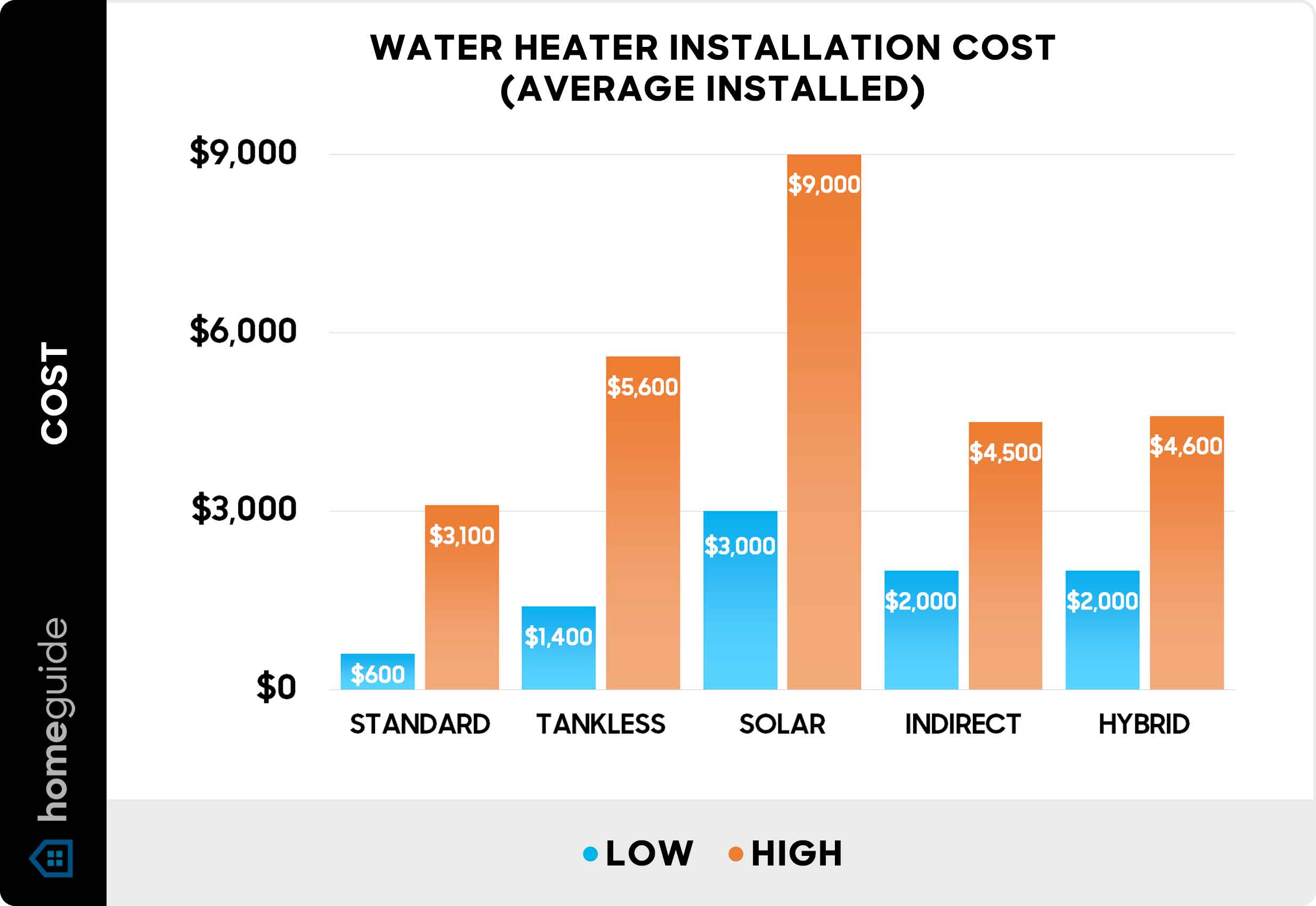

Consider this example for potential savings through a utility rebate. Imagine you purchase a high-efficiency tankless water heater that qualifies for a $500 rebate from your utility company. By carefully following the application process and providing the necessary documentation, you can effectively reduce the overall cost of your upgrade by $500. This is a significant savings that makes the investment in a tankless system even more appealing.

Final Thoughts on the California Tax Credit for Tankless Water Heater

While a straightforward “California tax credit for tankless water heater” might not be the primary form of financial assistance, various rebates and incentives are available to help offset the cost. By carefully researching utility company programs, local government initiatives, and federal guidelines, homeowners can significantly reduce the financial burden of upgrading to an energy-efficient tankless water heater. Investigating all available options and meticulously documenting your installation is key to maximizing your potential savings.

Furthermore, it’s advisable to obtain quotes from multiple installers. The cost of installation can vary significantly depending on the complexity of the job, the location of the unit, and the installer’s rates. Gathering several quotes allows you to compare pricing and ensure you’re getting the best possible deal. Be sure to inquire about any additional fees, such as plumbing modifications or electrical upgrades, that may be necessary.

FUTURE CONSIDERATIONS FOR TANKLESS WATER HEATER TECHNOLOGY

The technology surrounding tankless water heaters is constantly evolving. Manufacturers are continuously innovating to improve efficiency, reduce emissions, and enhance user experience. Keep an eye on emerging trends such as:

– Smart Tankless Water Heaters: These models offer features such as remote control, leak detection, and energy usage monitoring via smartphone apps.

– Hybrid Tankless Systems: Combining tankless technology with a small storage tank can provide a buffer for high-demand periods and potentially improve overall efficiency.

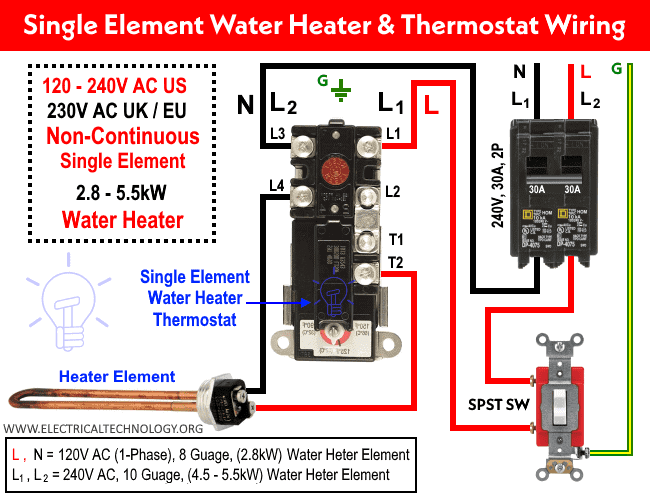

– Propane vs. Natural Gas vs. Electric: Evaluate the fuel source options based on availability, cost, and environmental impact in your specific area. Each type has its own advantages and disadvantages.

Before making a final decision, consider the long-term implications of your choice. A tankless water heater is a significant investment, so it’s essential to select a model that meets your current and future needs. Think about factors such as the number of occupants in your home, the frequency of hot water usage, and any potential future renovations that may impact your hot water demand.

NAVIGATING THE APPLICATION PROCESS

Applying for rebates or incentives typically involves a specific process that must be followed carefully. This often includes submitting online applications, providing supporting documentation, and undergoing verification procedures. Read the terms and conditions of each program thoroughly to ensure you meet all eligibility requirements and adhere to the application deadlines. Failure to comply with the specified procedures could result in denial of the incentive.