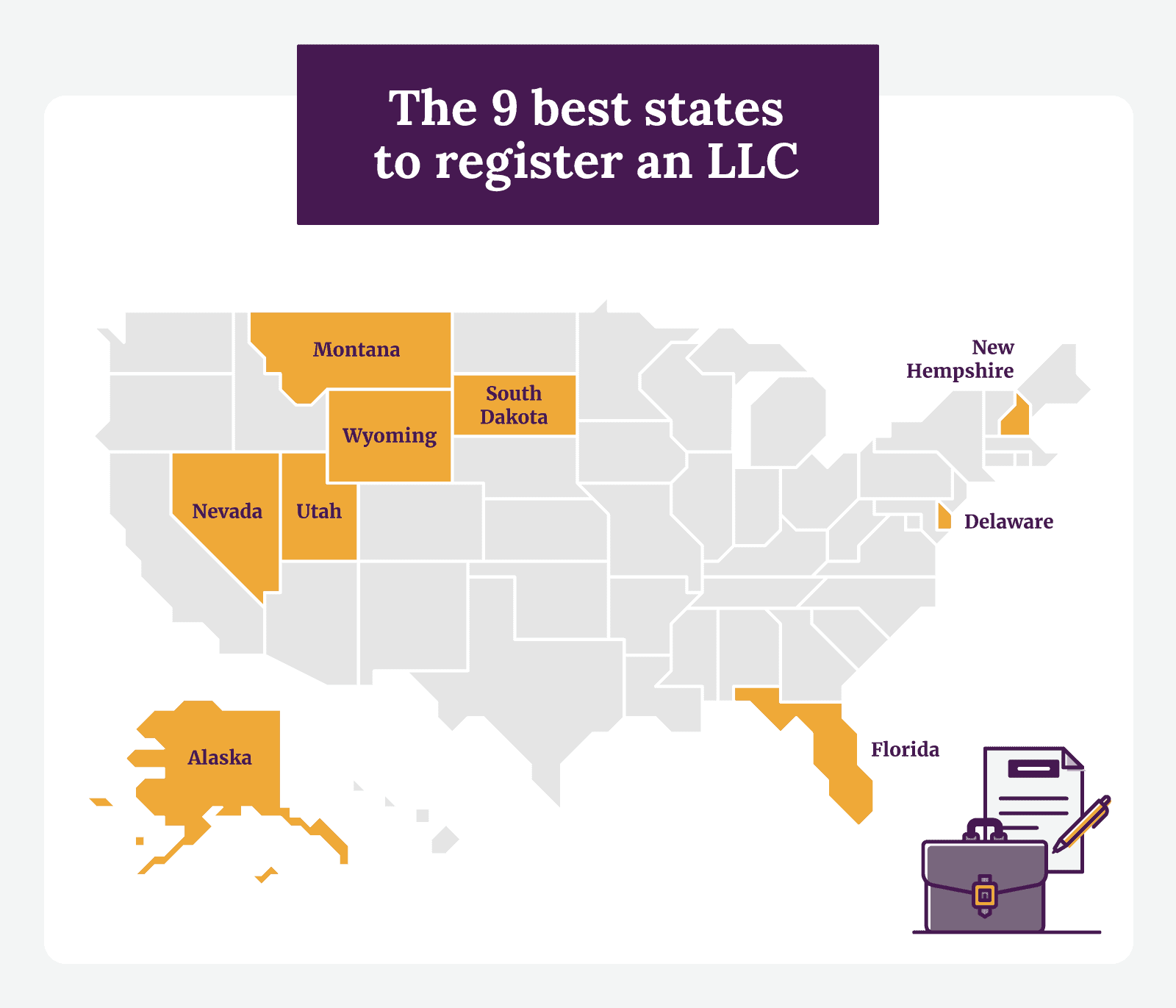

Choosing the right state to form your Limited Liability Company (LLC) is a crucial decision that can significantly impact your business’s legal and financial standing. While Delaware and Nevada are often touted as the go-to states, other options may be more advantageous depending on your specific needs and circumstances. Navigating the complexities of state regulations and business laws requires careful consideration to ensure your LLC is set up for success. This article explores the 5 Best States To Form An LLC, offering insights into factors such as tax benefits, privacy protection, and regulatory flexibility to help you make an informed choice. Understanding these nuances is key to optimizing your business structure and minimizing potential liabilities.

Why State Choice Matters for Your LLC

The state you choose to form your LLC governs the legal framework under which your business operates. This choice influences several key aspects:

- Taxes: State income taxes, franchise taxes, and sales taxes can vary significantly, impacting your overall profitability.

- Privacy: Some states offer greater anonymity for LLC members and managers.

- Regulations: States differ in their reporting requirements, annual fees, and overall regulatory burden.

- Legal Protection: The state’s laws can affect the level of protection offered to LLC members from personal liability.

The Top 5 States for LLC Formation

Here’s a breakdown of five states that offer compelling advantages for LLC formation:

1. Wyoming: Privacy and Low Costs

Wyoming has emerged as a popular choice for LLCs due to its strong privacy protections. Wyoming allows for “nominee” directors and managers, shielding the identity of the actual owners. The state also has no corporate or individual income tax. Formation costs and annual fees are relatively low, making it an attractive option for small businesses and startups.

2. Delaware: Business-Friendly Courts

Delaware is renowned for its well-established and business-friendly court system, particularly the Court of Chancery, which specializes in corporate law. This is especially beneficial if you anticipate potential legal disputes. While Delaware’s franchise tax can be higher than other states, its legal infrastructure can be worth the investment for certain businesses.

3. Nevada: No State Income Tax

Nevada boasts no state income tax, making it a tax-advantaged location for LLCs. The state also offers some privacy protections, although not as extensive as Wyoming. Nevada’s business-friendly environment and lack of state income tax can be a significant draw for entrepreneurs.

4. South Dakota: Asset Protection

South Dakota has increasingly become popular due to its robust asset protection laws. These laws can provide an extra layer of security for your personal assets in the event of legal challenges. The state also offers a streamlined process for forming an LLC.

5. New Mexico: One of the Cheapest Options

New Mexico is one of the most affordable states to form an LLC. The fees are relatively low, and it doesn’t require you to have a registered agent in the state. This makes New Mexico a great choice if you are looking for a low-cost option, especially if you reside in the state.

FAQ: Choosing the Right State for Your LLC

- Q: What’s the most important factor when choosing a state?

- A: It depends on your individual business needs. Consider factors like taxes, privacy, legal protection, and regulatory burden.

- Q: Do I need to live in the state where I form my LLC?

- A: No, you can form an LLC in any state, regardless of your residency.

- Q: What is a registered agent?

- A: A registered agent is a person or entity designated to receive legal and official documents on behalf of your LLC.

- Q: What are the ongoing costs of maintaining an LLC?

- A: Ongoing costs may include annual fees, registered agent fees, and state taxes.

Ultimately, the best state to form your LLC depends on your specific circumstances and priorities. Carefully weigh the advantages and disadvantages of each state before making a decision. Remember to consult with legal and financial professionals to ensure you choose the option that best aligns with your business goals. This thorough approach will allow you to take advantage of the benefits of forming an LLC and position your business for long-term success. The decision to find the 5 Best States To Form An LLC can be a strategic advantage for your company.