Understanding how much electricity a hot water heater uses is crucial for managing your energy consumption and potentially lowering your utility bills. Many homeowners are unaware of the significant draw these appliances have on their electrical grid. This guide dives deep into the factors influencing hot water heater electricity usage, helping you estimate your costs and explore energy-saving strategies. Ultimately, knowing how much electricity a hot water heater uses can empower you to make informed decisions about your home’s energy efficiency.

Factors Influencing Hot Water Heater Electricity Consumption

Several key elements determine how much electricity your hot water heater consumes. Let’s explore these in detail:

- Tank Size: Larger tanks require more energy to heat and maintain the desired water temperature. A larger tank will naturally use more electricity.

- Usage Habits: The frequency and volume of hot water used greatly impact electricity consumption. Longer showers, frequent laundry loads, and running the dishwasher all contribute.

- Thermostat Setting: Higher thermostat settings demand more energy to maintain the water at the set temperature. Setting it too high can also be a safety hazard.

- Insulation: Poorly insulated tanks lose heat more quickly, forcing the heater to work harder and use more electricity to compensate.

- Age of the Unit: Older water heaters tend to be less efficient than newer models, leading to higher energy consumption. Internal components may also degrade over time, affecting performance.

Estimating Your Hot Water Heater’s Electricity Usage

While an exact calculation requires specific details about your appliance and usage patterns, here’s a general approach to estimate your electricity consumption:

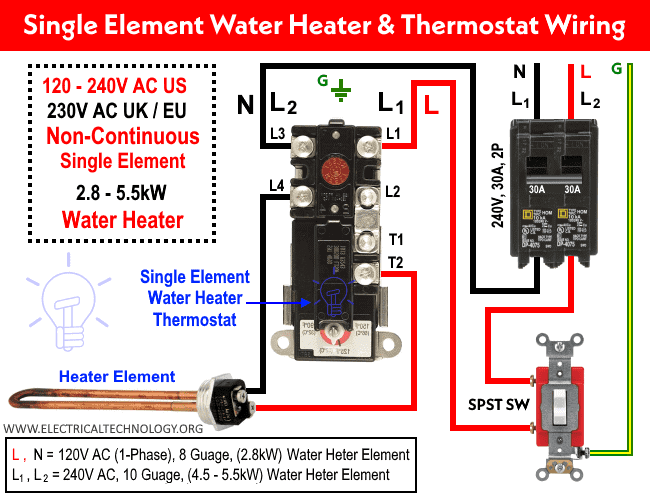

- Determine the Heater’s Wattage: Find the wattage rating on the heater’s nameplate (usually located on the side of the tank).

- Estimate Daily Usage Hours: Consider how many hours per day the heater is actively running to maintain the water temperature. This is often much less than 24 hours.

- Calculate Daily Energy Consumption: Multiply the wattage by the daily usage hours to get watt-hours. Divide by 1000 to convert to kilowatt-hours (kWh).

- Calculate Monthly Energy Consumption: Multiply the daily kWh by the number of days in the month.

- Calculate Monthly Cost: Multiply the monthly kWh by your electricity rate (found on your utility bill) to estimate the monthly cost.

Example: A 4500-watt water heater running for 3 hours per day would consume (4500 watts * 3 hours) / 1000 = 13.5 kWh per day. Over 30 days, that’s 405 kWh. At a rate of $0.15 per kWh, the monthly cost would be $60.75.

Comparative Table: Estimated Annual Electricity Consumption for Different Tank Sizes

| Tank Size (Gallons) | Estimated Annual kWh Usage (Average Family) |

|---|---|

| 40 | 2400 ─ 3000 |

| 50 | 2800 ─ 3500 |

| 60 | 3200 ─ 4000 |

| 80 | 4000 ─ 5000 |

Tips for Reducing Hot Water Heater Electricity Consumption

- Lower the Thermostat: Setting the thermostat to 120°F (49°C) is generally sufficient and can save energy.

- Insulate the Tank: Add an insulation blanket to your water heater to reduce heat loss.

- Insulate Hot Water Pipes: Insulating the first few feet of hot water pipes can prevent heat loss as water travels from the heater to the faucet.

- Fix Leaks Promptly: Even small leaks can waste a significant amount of hot water over time.

- Install Low-Flow Showerheads and Faucet Aerators: These devices reduce water usage without sacrificing water pressure.

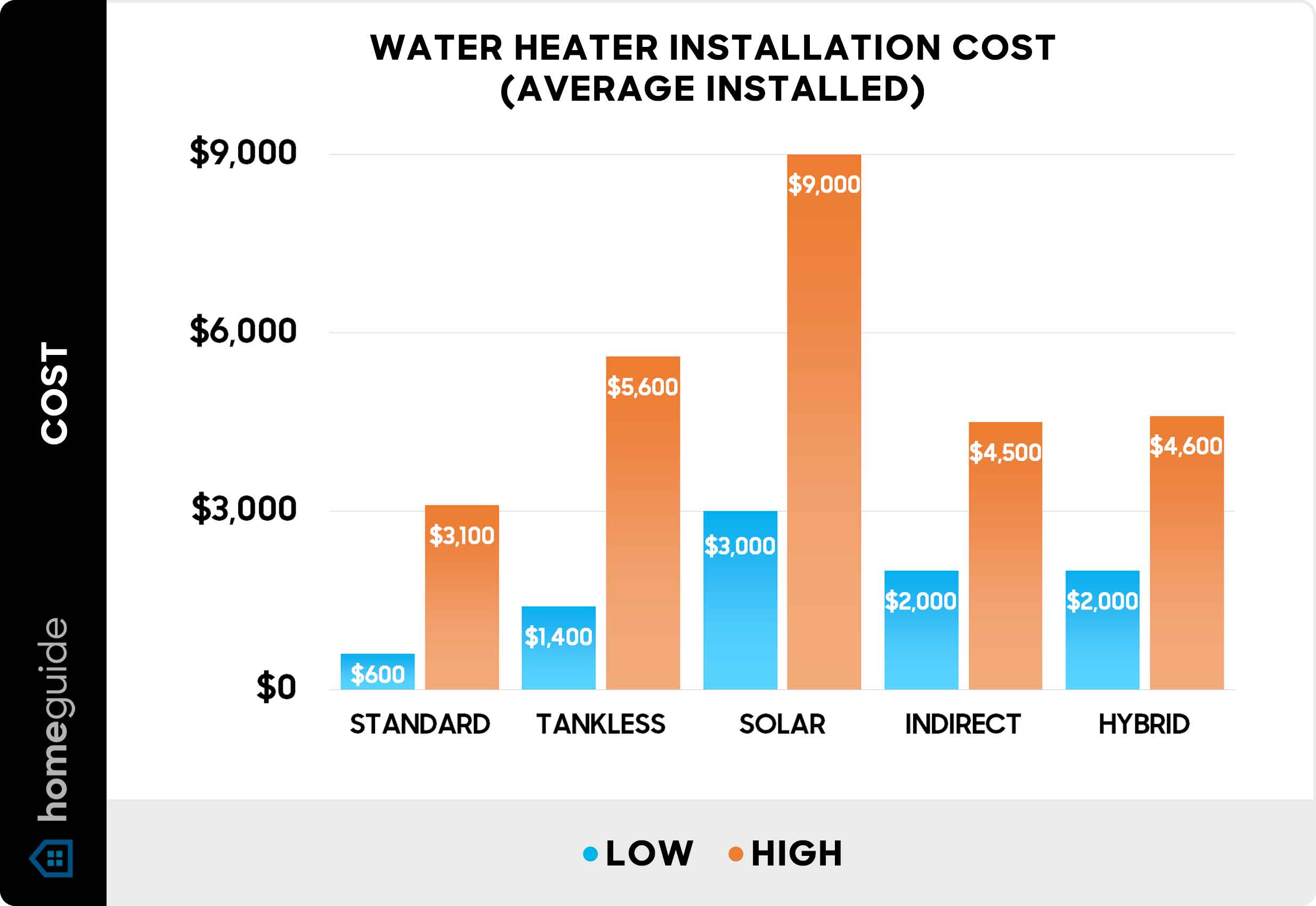

- Consider a Tankless Water Heater: Tankless models heat water on demand, eliminating standby heat loss;

EMBRACING ENERGY-EFFICIENT HOT WATER SOLUTIONS: A STEP-BY-STEP GUIDE

Following the initial understanding of your hot water heater’s electricity consumption, it’s time to take proactive steps to minimize your energy footprint and maximize savings. Consider this guide as your personal roadmap to a more efficient and cost-effective hot water system. We’ll explore practical strategies, advanced technologies, and behavioral adjustments to empower you in your energy-saving journey.

DIAGNOSING YOUR CURRENT SYSTEM: A DETAILED ASSESSMENT

Before implementing any changes, conduct a thorough assessment of your existing hot water system. This involves:

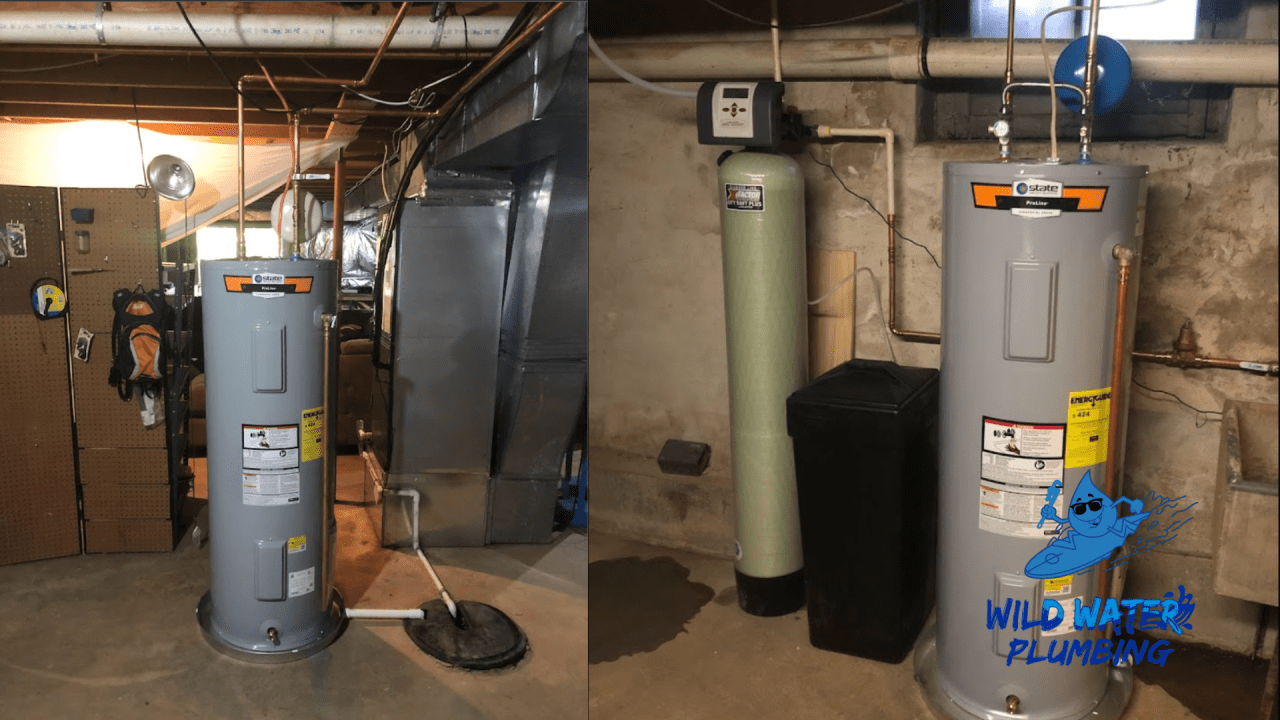

– Inspecting the Tank and Plumbing: Look for signs of rust, corrosion, or leaks around the tank and connected pipes. Address any issues promptly to prevent further damage and water waste.

– Evaluating Insulation Levels: Check the insulation on your tank and pipes. If it’s inadequate or damaged, consider replacing it with high-quality insulation materials.

– Monitoring Water Temperature: Use a thermometer to verify the actual water temperature against your thermostat setting. Discrepancies may indicate a malfunctioning thermostat or heat loss.

– Analyzing Your Usage Patterns: Track your hot water usage over a week or two to identify peak consumption times and areas where you can reduce demand.

INVESTING IN UPGRADES: SMART CHOICES FOR LONG-TERM SAVINGS

Depending on your assessment, consider these upgrades to enhance your hot water system’s efficiency:

TANKLESS WATER HEATERS: THE ON-DEMAND SOLUTION

Tankless water heaters, also known as on-demand water heaters, heat water only when you need it, eliminating the standby heat loss associated with traditional tanks. While they have a higher upfront cost, the long-term energy savings can be substantial. Consider these factors when deciding if a tankless heater is right for you:

– Fuel Type: Tankless heaters can be powered by electricity or natural gas. Choose the fuel type that’s most efficient and cost-effective in your area.

– Flow Rate: Ensure the tankless heater’s flow rate is sufficient to meet your household’s peak hot water demand.

– Installation Requirements: Tankless heaters often require professional installation, especially gas-powered models.

HEAT PUMP WATER HEATERS: HARNESSING AMBIENT HEAT

Heat pump water heaters (HPWHs) use electricity to move heat from one place to another, rather than generating heat directly. They extract heat from the surrounding air and transfer it to the water tank. HPWHs are significantly more energy-efficient than traditional electric water heaters, but they require a location with adequate airflow and temperature. Consider these factors:

– Climate: HPWHs perform best in warmer climates. In colder climates, they may require a backup heating element.

– Space Requirements: HPWHs are typically larger than traditional water heaters and require adequate space for installation and airflow.

– Rebates and Incentives: Check for local rebates and incentives that can help offset the upfront cost of an HPWH.

ADOPTING ENERGY-CONSCIOUS HABITS: SMALL CHANGES, BIG IMPACT

Even without investing in new equipment, you can significantly reduce your hot water consumption by adopting these simple habits:

– Shorter Showers: Reduce your shower time by a few minutes each day.

– Repair Leaks Immediately: Fix any leaky faucets or pipes as soon as possible.

– Wash Clothes in Cold Water: Most laundry detergents are effective in cold water, saving energy on heating.

– Run Full Loads: Only run the dishwasher and washing machine when they are fully loaded.

– Optimize Dishwasher Settings: Use the energy-saving settings on your dishwasher and air-dry dishes when possible.

Remember, consistent effort in adopting these strategies will yield substantial results over time. By taking a proactive and informed approach, you can transform your hot water system into an energy-efficient asset, contributing to a greener future and lower utility bills. Don’t underestimate the power of small changes combined with smart upgrades to make a significant difference in controlling how much electricity does a hot water heater use.