The modern kitchen is increasingly demanding convenience and efficiency‚ and nothing embodies this more than a high-quality 2-handle instant hot and cold water dispenser faucet. Imagine the ability to instantly access boiling water for tea or sterilizing baby bottles‚ followed immediately by chilled‚ refreshing water for hydration on a hot day‚ all from a single‚ stylish fixture. These sophisticated faucets not only streamline your kitchen tasks but also add a touch of elegance and sophistication to your countertop‚ making them a worthwhile investment for any homeowner seeking to upgrade their culinary experience. The 2-handle instant hot and cold water dispenser faucet offers a seamless blend of functionality and aesthetics‚ becoming a focal point in any modern kitchen design.

Benefits of a 2-Handle Instant Hot and Cold Water Dispenser Faucet

Beyond the obvious convenience of instant hot and cold water‚ these faucets offer a multitude of benefits that can significantly improve your daily life:

- Time Saving: Eliminate the need to wait for kettles to boil or refrigerators to chill water.

- Water Conservation: Dispense only the amount of water you need‚ reducing waste.

- Enhanced Safety: Many models feature safety mechanisms to prevent accidental dispensing of hot water‚ especially important for households with children.

- Improved Hygiene: Enjoy filtered water on demand‚ free from impurities and contaminants.

- Stylish Design: Available in a variety of finishes and styles to complement any kitchen decor.

Choosing the Right Faucet for Your Needs

Selecting the perfect 2-handle instant hot and cold water dispenser faucet requires careful consideration of several factors:

Water Filtration System

Consider the type of water filtration system included or compatible with the faucet. Options range from simple carbon filters to more advanced reverse osmosis systems.

Tank Size

The tank size determines the amount of hot water available on demand. Choose a size that meets your household’s typical usage patterns.

Spout Reach and Height

Ensure the spout reach and height are appropriate for your sink configuration and the size of pots and pans you frequently use.

Finish and Style

Select a finish and style that complements your existing kitchen fixtures and overall decor. Common finishes include chrome‚ stainless steel‚ and brushed nickel.

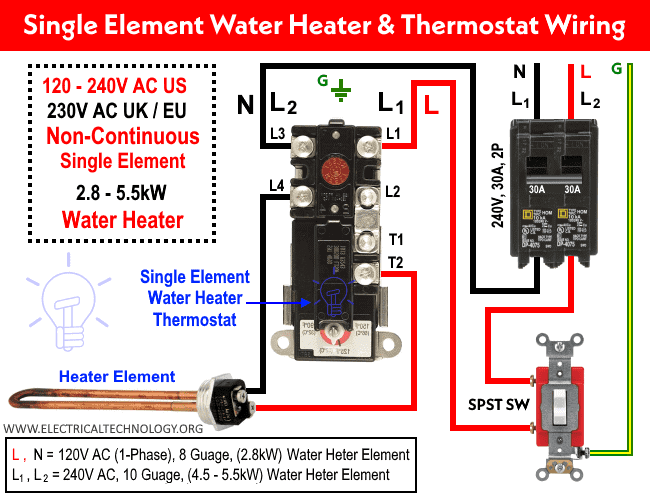

Installation and Maintenance

Installation may require professional plumbing services‚ particularly if you are not familiar with plumbing connections. Regular maintenance typically involves replacing filters according to the manufacturer’s recommendations. Proper care will ensure the longevity and optimal performance of your faucet.

ADVANCED FEATURES AND TECHNOLOGIES

Contemporary iterations of the 2-handle instant hot and cold water dispenser faucet frequently incorporate advanced features and cutting-edge technologies that further augment their utility and user experience. These enhancements may include:

– Digital Temperature Control: Precise temperature settings for both hot and cold water‚ allowing for customized dispensing based on specific requirements.

– Energy-Saving Modes: Features designed to minimize energy consumption during periods of inactivity‚ contributing to reduced utility costs.

– Scale Prevention Systems: Integrated mechanisms to mitigate the build-up of mineral deposits‚ thereby prolonging the lifespan of the heating element and maintaining optimal water flow.

– Touchless Operation: Certain models offer touchless dispensing capabilities‚ promoting hygiene and ease of use.

– Leak Detection and Shut-Off: Advanced sensors that detect potential leaks and automatically shut off the water supply to prevent damage.

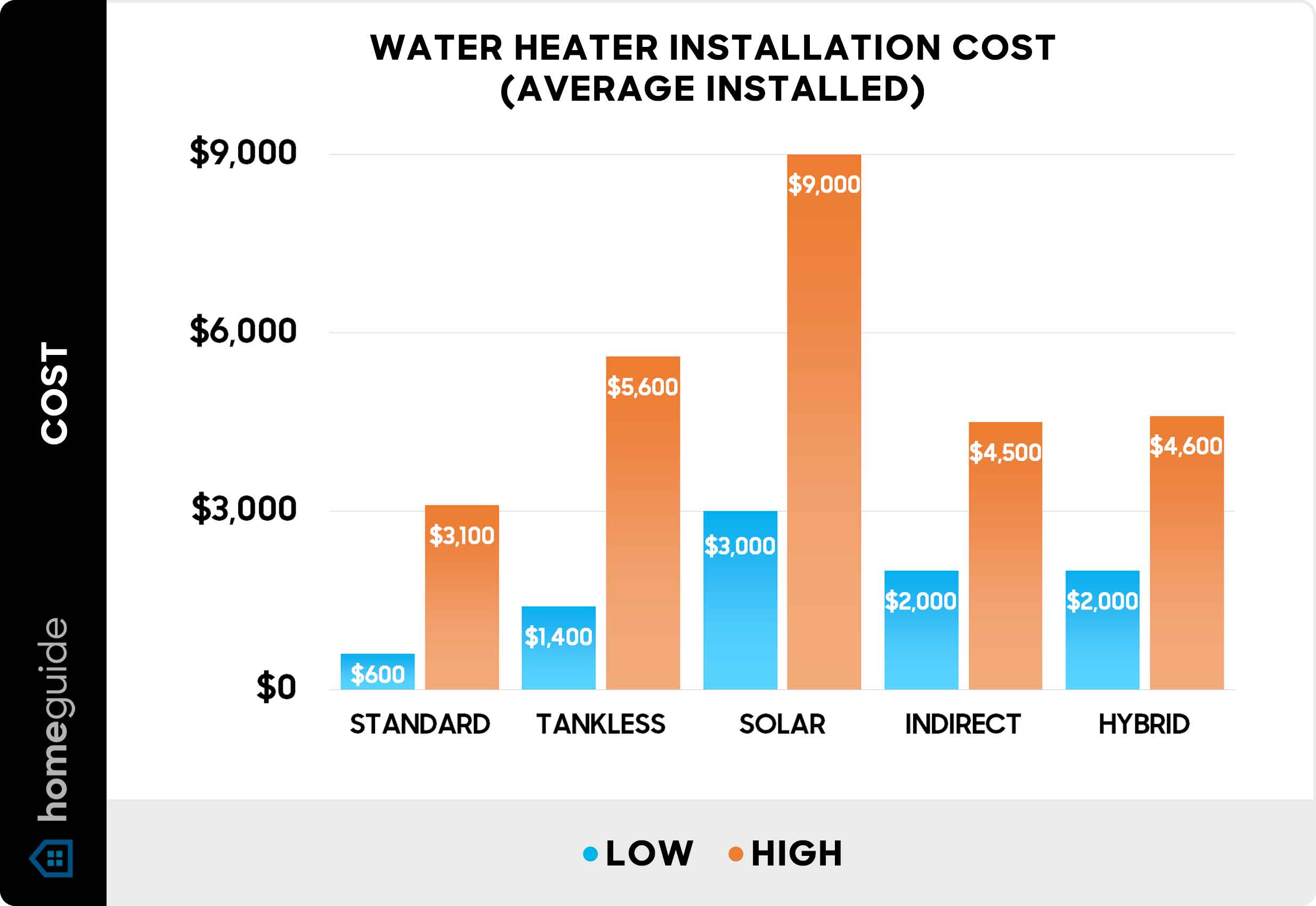

COST-BENEFIT ANALYSIS

While the initial investment in a 2-handle instant hot and cold water dispenser faucet may be more substantial than that of a conventional faucet‚ a comprehensive cost-benefit analysis often reveals significant long-term savings and advantages. The elimination of reliance on electric kettles and bottled water‚ coupled with the reduction in water waste‚ can translate to considerable cost savings over time. Furthermore‚ the enhanced convenience and improved quality of life afforded by these faucets contribute to their overall value proposition.

FUTURE TRENDS IN FAUCET TECHNOLOGY

The evolution of faucet technology is ongoing‚ with future trends poised to further enhance the functionality and efficiency of 2-handle instant hot and cold water dispenser faucets. Anticipated advancements include:

– Integration with Smart Home Systems: Seamless connectivity with smart home platforms‚ enabling remote control and monitoring of faucet functions.

– AI-Powered Water Optimization: The utilization of artificial intelligence to analyze water usage patterns and optimize dispensing parameters for maximum efficiency.

– Enhanced Filtration Technologies: The development of more advanced filtration systems capable of removing an even wider range of contaminants from water.

– Sustainable Materials and Manufacturing: A growing emphasis on the use of sustainable materials and environmentally responsible manufacturing processes.

The modern 2-handle instant hot and cold water dispenser faucet represents a significant advancement in kitchen technology‚ offering a compelling blend of convenience‚ efficiency‚ and style. As technology continues to evolve‚ these faucets are poised to become an increasingly indispensable component of the contemporary home.