Decoding the serial number on your American Water Heater is crucial for accessing important information about your appliance, from its manufacturing date to specific model details. Understanding how to perform an American water heater company serial number lookup can save you time and frustration when needing replacement parts, troubleshooting issues, or even determining warranty coverage. This unique guide will explain the methodology behind these codes, allowing you to efficiently navigate the process. The ability to correctly perform an American water heater company serial number lookup will give you more control over your home’s maintenance.

Understanding the Serial Number Structure

American Water Heater serial numbers typically follow a specific pattern. While variations may exist depending on the model and year of manufacture, a common format includes a combination of letters and numbers that reveal key details about the unit. Let’s break down the elements you might encounter:

- Manufacturing Date: Often, the first four digits represent the month and year of manufacture. For example, “1223” could indicate December 2023.

- Production Week: Some serial numbers include a code for the week of the year the water heater was produced.

- Sequential Number: The remaining digits usually represent a sequential number, indicating the specific unit’s position in the production line.

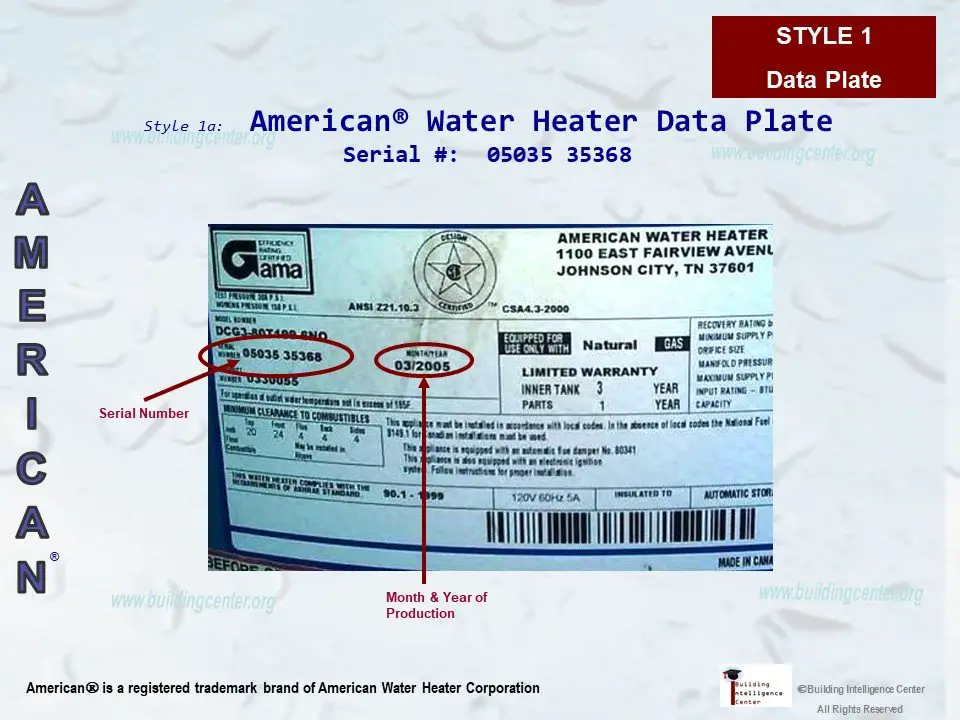

Where to Find the Serial Number

The serial number is usually located on a rating plate or sticker attached to the water heater. Common locations include:

- The upper portion of the tank

- Near the gas valve (for gas water heaters)

- On the side of the unit

Always check your owner’s manual for specific instructions on locating the serial number for your particular model.

Methods for Performing a Serial Number Lookup

Once you’ve located the serial number, here are a few methods you can use to decode it:

Online Resources

Many websites offer online serial number lookup tools specifically for American Water Heater products. These tools often require you to enter the serial number, and they will then provide information about the manufacturing date, model, and other relevant details.

Contacting Customer Service

The most reliable method for obtaining accurate information is to contact American Water Heater Company’s customer service directly. Provide them with the serial number, and they will be able to provide you with the exact details of your unit.

Decoding the Serial Number Manually

While online tools and customer service are preferred, you can often decipher the serial number manually using the information in the “Understanding the Serial Number Structure” section above. This may require some research and familiarity with American Water Heater’s coding system.

Example Serial Number Decoding

Let’s imagine a serial number: “1022123456”.

* “1022” likely indicates October 2022 as the manufacture date.

* The remaining digits “123456” could represent a sequential production number.

Keep in mind that this is a simplified example. The actual format might vary depending on the model and year.

Troubleshooting Common Lookup Issues

Sometimes, you might encounter issues when trying to perform a lookup. Here are some common problems and potential solutions:

- Illegible Serial Number: If the serial number is faded or damaged, try using a magnifying glass or taking a well-lit photograph to improve readability.

- Incorrect Serial Number: Double-check that you have entered the serial number correctly, paying close attention to similar-looking characters (e.g., 0 and O, 1 and I).

- No Results Found: If an online tool returns no results, try contacting customer service or manually decoding the serial number.

Final Thoughts

Understanding how to perform an American water heater company serial number lookup is a valuable skill for any homeowner. By following the steps outlined in this guide, you can quickly and easily access important information about your water heater, saving you time and money in the long run.